Are operational inefficiencies holding you back?

Unlock new channels for growth in today’s thriving private markets by cutting through complexity – consolidating data, automating processes, and enhancing investor transparency.

Speak to usWhy is private credit more attractive than ever?

Sophisticated investors continue to prioritise yield as interest rates, while rising, remains historically low. In response, managers are exploring alternative strategies and broader diversification, driving innovation and increasing complexity in structuring and managing private credit funds.

Explore our solutionA market built for resilient returns. Is your infrastructure ready?

What’s fuelling this booming sector, and how are managers navigating both opportunities and operational challenges?

Read the Hedgeweek report.

28%

More than a quarter of firms planning or launching private credit funds

x2

Private credit set to double again by 2028

$3.5tn

Estimate of total private credit market value by 2028

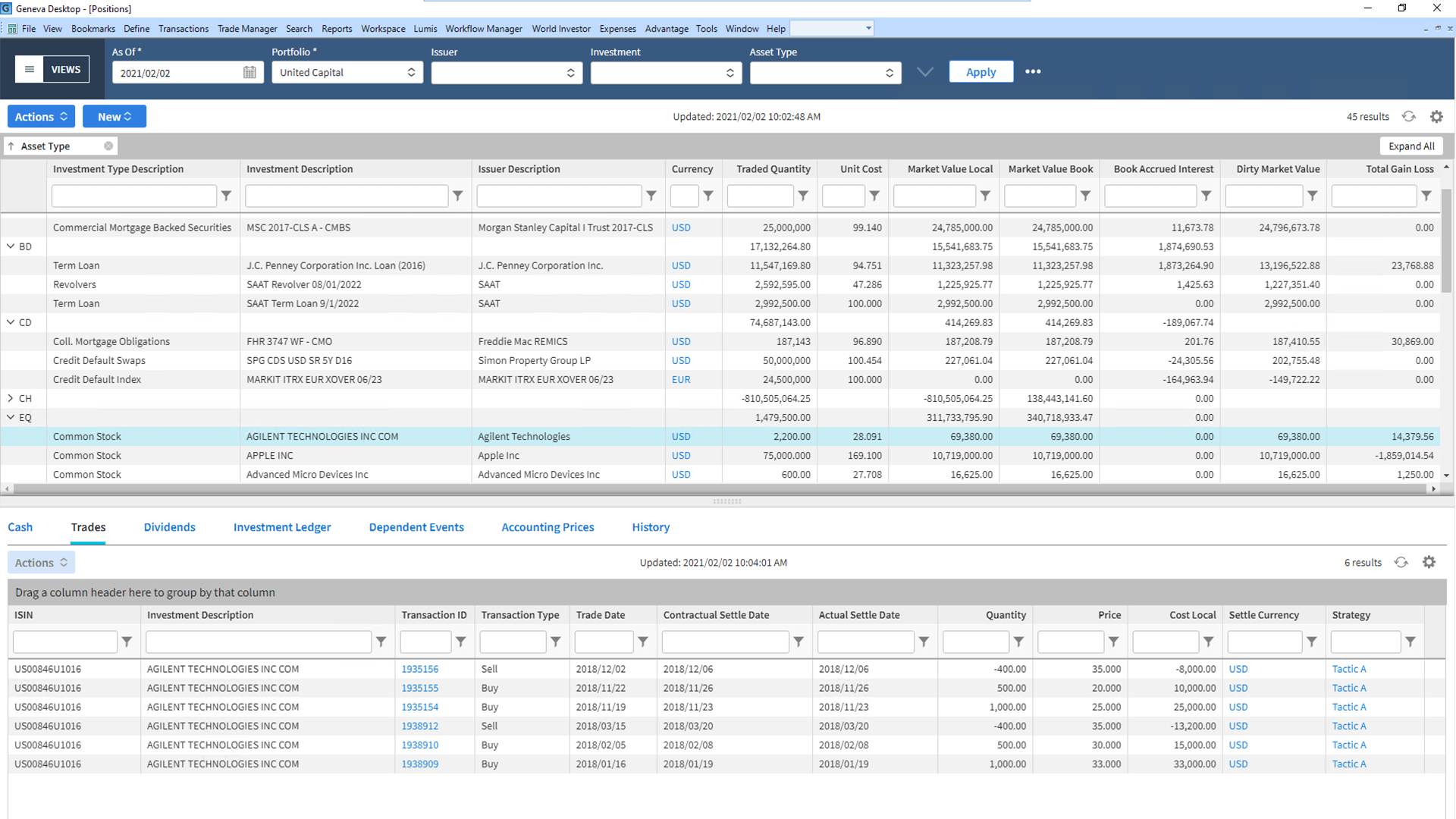

Geneva: built for scale, designed for complexity

Manage diverse portfolios and multi-asset strategies with an all-in-one platform that handles transactions across private equity, private debt, and multiple asset classes. Streamline operational complexity and unify portfolios without costly integrations.

Upgrade your technology to gain the flexibility, precision and scale that private credit demands. Differentiate your firm from the competition.

Update and centralise critical data infrastructure for impeccable data quality and integration. Make workflows more efficient to support seamless growth and prevent delays in reporting.

Harness intelligent automation and real-time insights to streamline regulatory compliance. Generate audit-ready reporting and ensure robust risk management as you optimise performance tracking for better analysis and inform decision making.

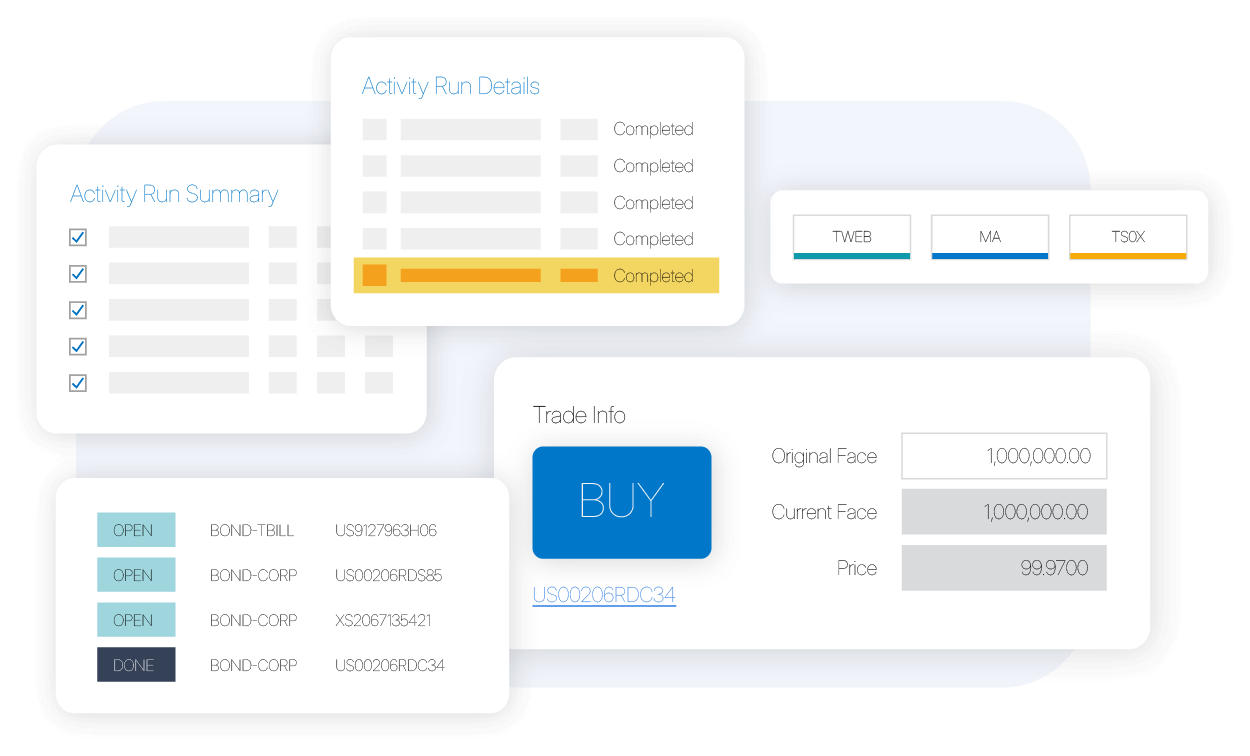

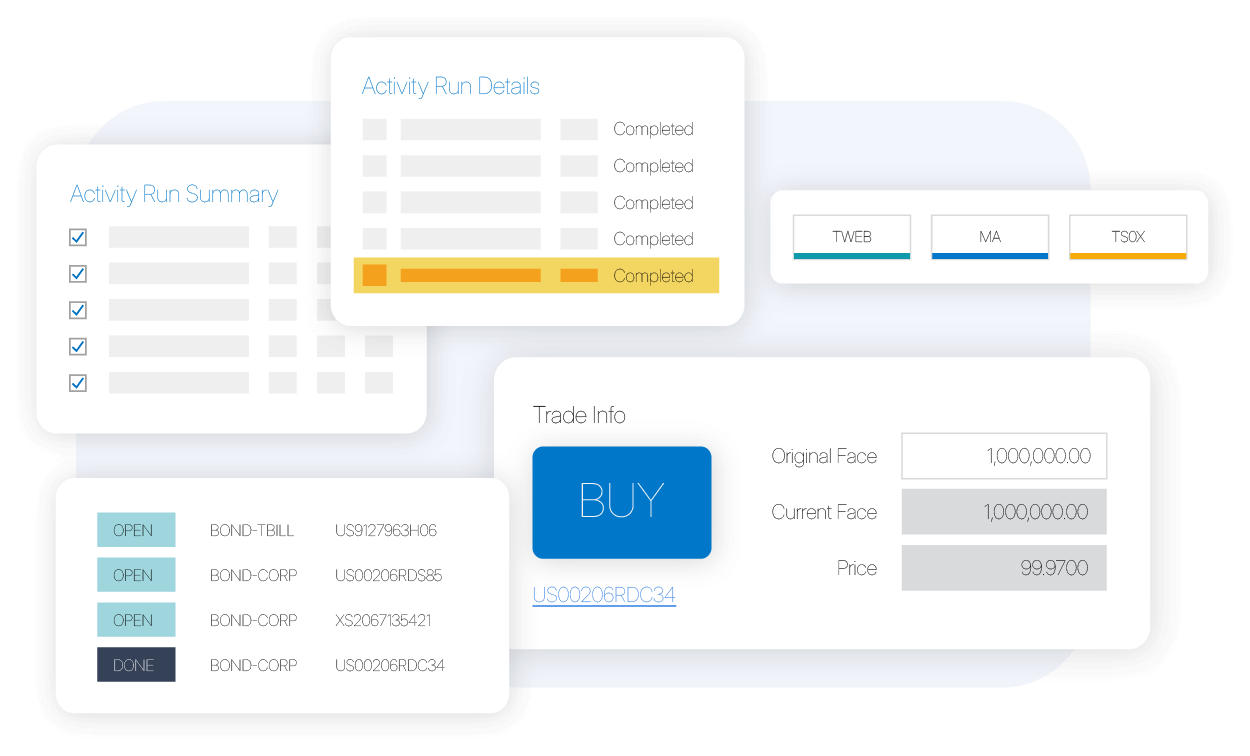

Seamless loan processing with Geneva & SS&C Loans

Private credit firms require speed, accuracy, and integration to stay ahead. Geneva and SS&C Loans together form a single unified platform that will transform how you manage private and syndicated loans.

Comprehensive support

For private debt and alternative investments

Automated data processing

For faster processing, more accurate accounting and reporting, and improved operational scalability

Efficient management of complex fund structures

Multi-currency investments, and flexible payment handling, including PIK transactions

Full lifecycle management

From origination to restructuring, streamlining reconciliation, ensuring data integrity, and reducing operational risk

Expert insight: infrastructure is the key to scaling

Invest in the right tech, guided by a trusted partner

5000+ clients

Firms of any type and size, from independent financial advisors to the most complex fund managers.

Across 50 countries

Supported by experienced local teams around the world that understand your business and your clients.

For nearly 40 years

Backed by decades of experience, innovation and proven solutions, and unmatched industry expertise.

Book a demo

See first-hand what Geneva can do

Expand without limits, lead the market.