Wealth management & traditional investments

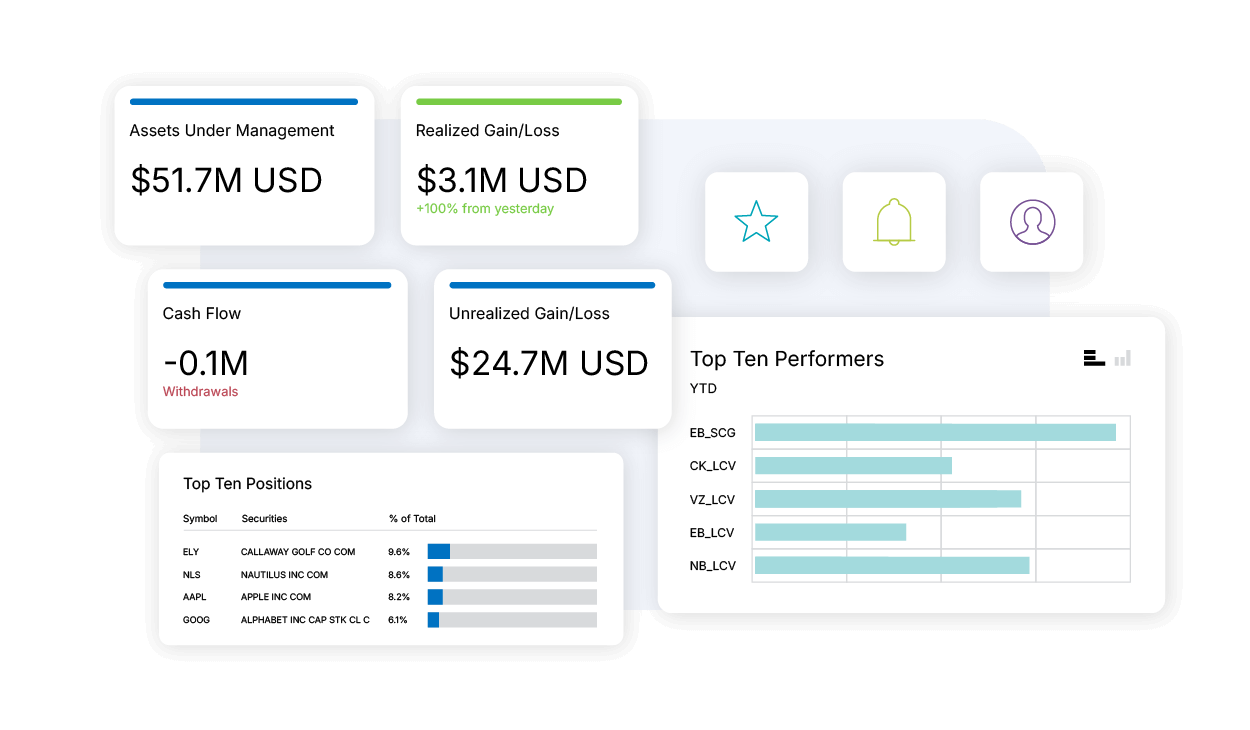

Make more informed investment decisions and increase efficiencies with a fully integrated solution, built around your workflows. Evolve your business with the Advent Investment Suite.

Request a demo

Stay competitive and adapt to what comes next

Adapt to changing markets with our modular, end-to-end solution. Gain accurate data, comprehensive reporting, automated workflows, and broad asset class coverage. Simplify operations with automation and managed services, so you can focus on client relationships and growth.

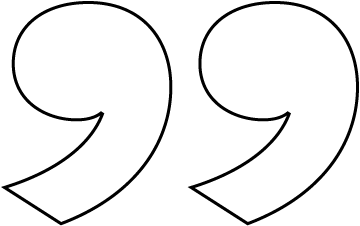

Enhance investment management workflows for a better client experience

- Enhanced client satisfaction and loyalty: Real-time portfolio access and intuitive interfaces significantly boost client satisfaction and trust.

- Business growth: By fostering stronger and more loyal client relationships, this platform enables long-term client retention and increased client value. Additionally, it creates a powerful and positive impression on new and prospective clients, attracting more business and accelerating growth through enhanced reputation and trust.

- Secure and flexible communication: Robust security features ensure safe and confidential communication, with customization options to adapt to evolving client needs and preferences.

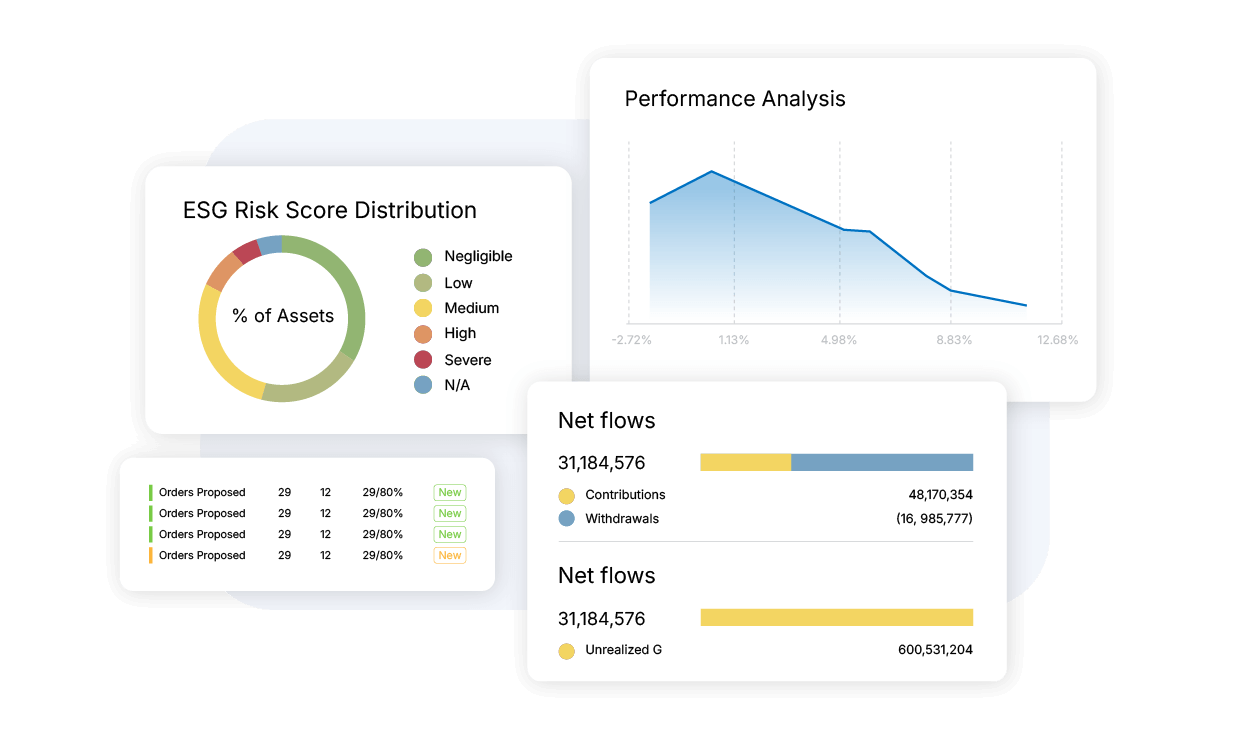

- Scalable business growth: support business expansion by efficiently managing numerous portfolios without the need for additional staff, ensuring scalability.

- Personalized portfolio customization: Facilitates tailored portfolio customization at scale, aligning with individual investor preferences and goals to gain a competitive edge.

- Front office coordination: Streamlines portfolio management and trading processes, reducing operational risk and enhancing productivity through seamless integration and coordination.

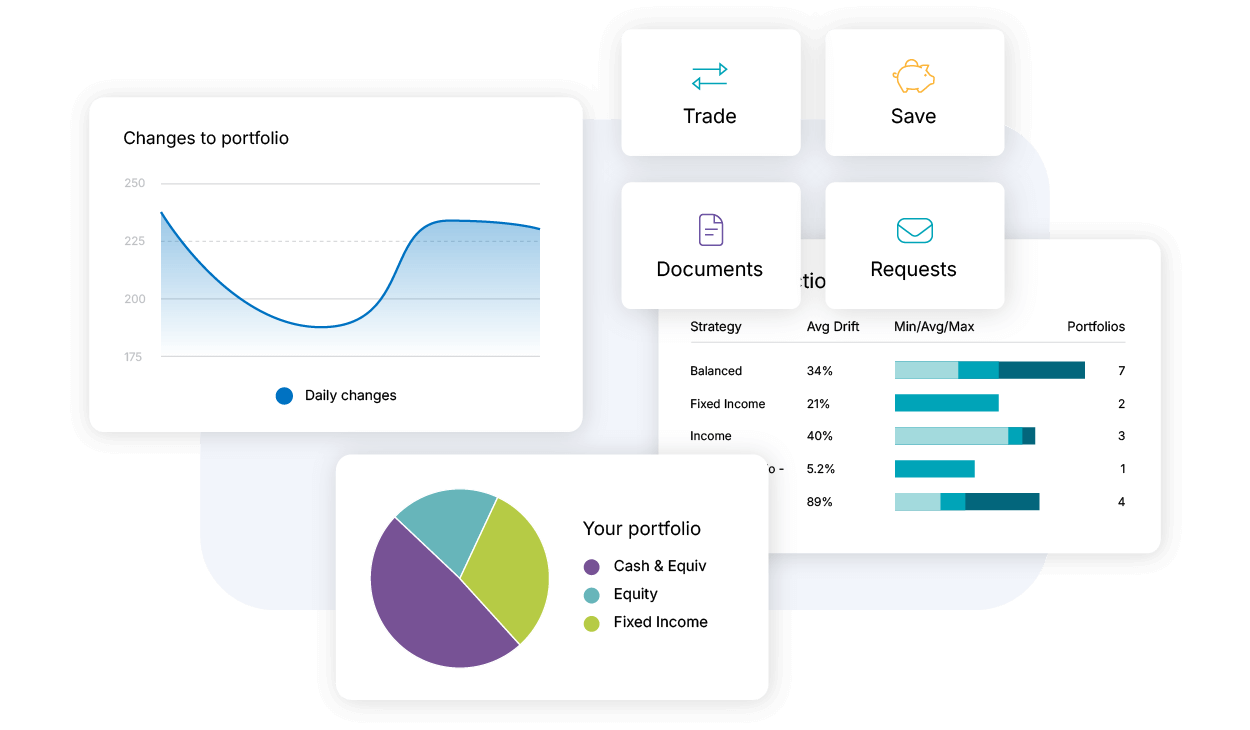

- Informed decision making: Provides real-time data and analytics for deeper market insights, enabling timely and informed investment decisions.

- Risk management and compliance: Offers comprehensive tools for compliance checks, reducing regulatory risk and ensuring adherence to internal policies and regulations.

- Automated operational efficiency: Automates trading workflows, reducing manual tasks and errors, leading to faster and more efficient order execution.

- Optimized operations: Automating processes reduces errors and boosts efficiency, enabling quick adaptation to new opportunities and regulatory changes.

- Investment flexibility: A versatile system supports diverse asset classes, allowing for agile investment decisions without system constraints.

- Front office enablement: Provides high-quality, timely information to enhance investment decisions and strengthen client engagement through well-informed interactions.

Get more insight

SEE ALL INSIGHTSRequest a demo

Please complete this form and one of our representatives will contact you soon to schedule a demo.