PRIVATE MARKETS: NO LONGER THE RISKY PATH

In volatile times, it’s tempting to stick with the familiar.

Even if returns aren’t what they used to be in public market environments, there is comfort in doing what you know: knuckling down, working with the systems you have.

In a climate of sustained geopolitical uncertainty and rising inflation, why would you complicate matters by considering a non-traditional path?

BECAUSE TODAY, THERE IS NO ALTERNATIVE.

1

DIVERSIFY NOW

ASSET CLASSES that were once thought of as risky or exotic – are the new “sensible”. Tremendous opportunities for strong returns and portfolio resilience now lie in private market assets such as private equity, private credit, real estate, real assets and other alternatives.

2

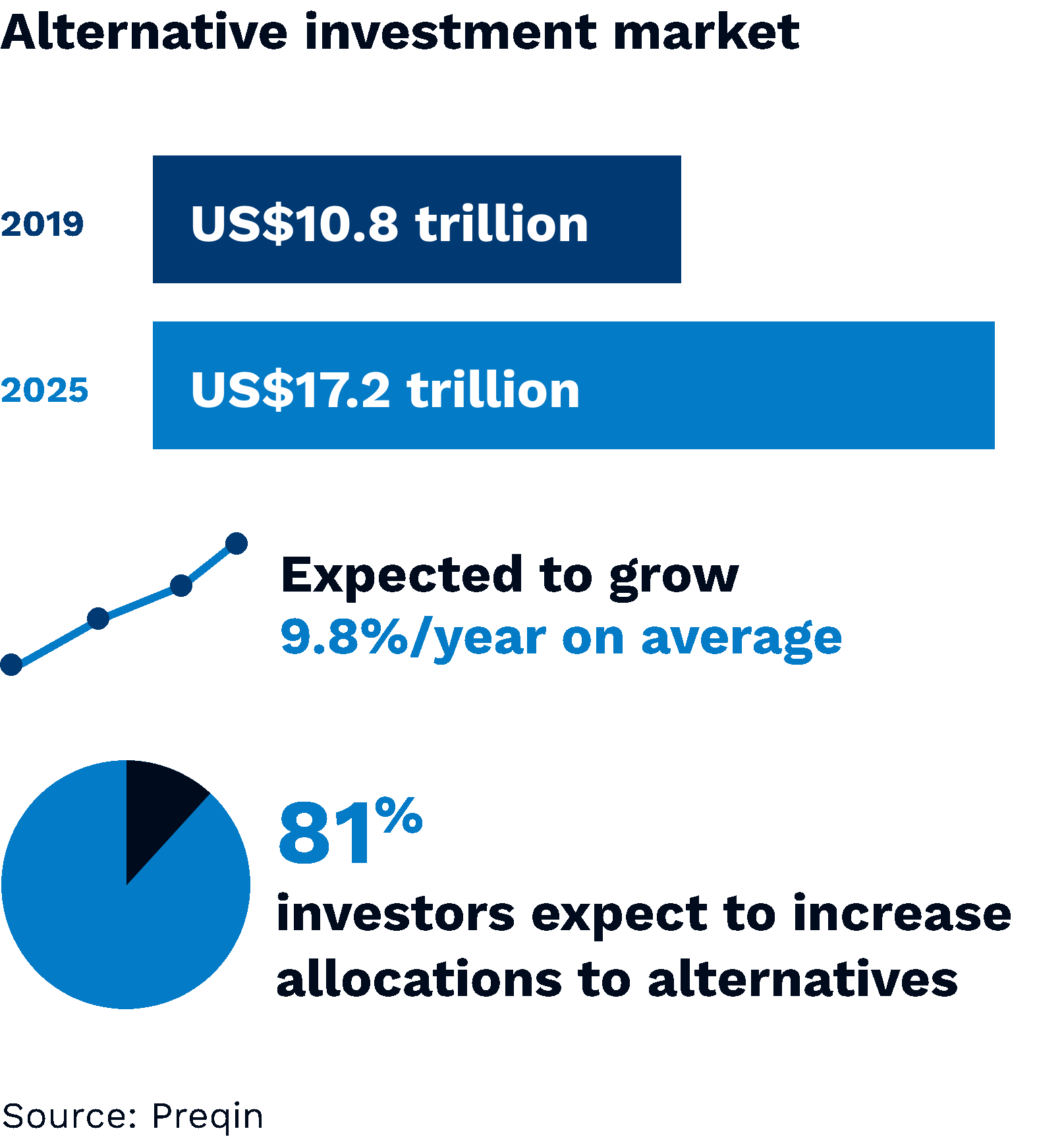

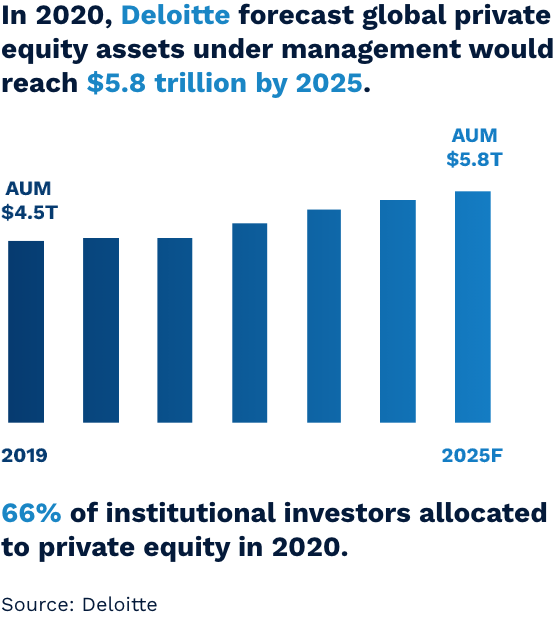

INVESTORS WANT TO DIVERSIFY NOW

MANY CLIENTS realise that private markets offer diversification, have less correlation to the stock market than traditional investments, and can be a hedge against inflation.

WITH BANKS shying away from risky loan book, private credit firms are stepping in. Investors see the opportunity for predictable returns from a known interest rate.

INVESTORS want both kinds of returns: cashflows from private credit to meet liabilities, and illiquid long-term investments – private equity.

PRIVATE MARKETS are showing solid historical returns.

3

BUT INVESTORS OFTEN CAN’T ACCESS ALTERNATIVES

Most traditional asset managers aren’t capable of offering clients private market alternatives.

Even though, with the right solution to manage multiple classes and complexities, firms can mix the public and the private with elegance and ease, providing clients with a modern rebalance of asset classes.

While there will be an upfront implementation expense in the transition to a new platform, the efficiency gains and profitability potential are huge.

4

GREATER EFFICIENCY DRIVES PROFITABILITY

CUSTOMISATION

Solutions are tailored to roles and firms, catering to back office, front office and everything in between

EFFICIENCY

Automated tracking, reporting and processing of instruments minimizes risk of errors. It removes operational barriers, freeing up fund managers’ time to focus on core objectives, enabling firms to dramatically increase operational efficiency in high volume, 24×7 operating environments.

SCALABILITY & FLEXIBILITY

Firms need systems that not only meet today’s requirements, but allow for future expansion. Geneva gives the flexibility to seamlessly support new strategy and diversified lines of business, keeping pace with and profiting from the market’s growth – without the need for expensive and inefficient integrations.

IMPROVED BOTTOM LINE

Achieve stronger margins by consolidating portfolios onto a single platform. Stop eroding margins with old or dysfunctional technology.

5

ALTERNATIVES MIGHT BE SENSIBLE,

BUT THEY’RE NOT SIMPLE

Traditional asset managers need that flexibility to manage cash flows.

How do firms manage complexity operationally? By using systems that can support a variety of fund types and strategies, each with markedly different accounting and reporting requirements. In particular, they need the capability to support both open- and closed-ended structures.

And those inflexible legacy systems operating in many firms? They won’t prevail. Nor will a string of multiple, single-purpose systems that create poorly integrated operational siloes and drain profitability.

6

GENEVA WAS MADE FOR COMPLEXITY

The Geneva portfolio accounting and management platform enables traditional asset managers to transition into alternatives with full confidence, knowing the platform is purpose built to deal with complexity.

GENEVA

- Comprehensive solution handles multiple moving constituent parts simultaneously

- Manages multi-asset, multi-currency strategies and complex global fund structures

- Supports traditional fixed-income securities, bank loans and swap agreements as well as private equity, private credit, real estate, real assets and hedge funds

- Allows firms to trade in, account for and report on virtually any alternative fund type

- Offers built-in support for both open- and closed-ended fund structures

- Provides the reporting detail and frequency that investors demand, in standardized formats as required, with the flexibility to meet clients’ specific reporting needs

- Gives greater transparency into a fund’s strategy, holdings and returns

- Opens up access to real-time data the way managers want it, when they need it, through easy dashboards

- If you’re an Asset Manager, Fund Manager, Asset Specialist or Mutual Fund Accountant and want to excel in private markets, act now with Geneva.

7

SAFE AND COMPLIANT

Geneva’s secure, safe hub incorporates proactive controls mandated by regulators, as well as state-of-the-art data governance and quality control. Firms can manage clients’ complex restrictions, and improve compliance readiness overall, with ILPA-compliant reporting templates built in.

8

Geneva Managed Services and outsourcing

Moving into private markets requires a level of expertise that can manage different kinds of vehicles. Ultimately firms will find themselves competing for specialist talent. Or – Geneva can assist with managed services delivered by a global team of experts.

There are also deployment and service options available with Advent Outsourcing Services, available on a spectrum ranging from full functionality access to a la carte. Outsourcing ensures firms always have the latest features and functionality of Geneva onboard, enabling quick, smooth changes.

Rebalance risk now, with Geneva

- Locally deployed or cloud delivered

- Excels at portfolio accounting and position management for any instrument, within any structure, in any region

- Enables investment managers to manage and grow their businesses efficiently, with a competitive edge powered by our solution suite

Behind Geneva® stands SS&C Advent

US$7 TRILLION IN ASSETS

Processed by firms worldwide through our system today

43 OF THE WORLD’S LARGEST FUND ADMINISTRATORS

relying on Advent Geneva

30 YEARS IN BUSINESS

Credentials rooted in our longevity and driven by the success of our clients

To excel in private markets, there is no alternative

SS&C Advent is the premier provider of portfolio and investor accounting for private market investments. Geneva® is our world-leading global portfolio accounting platform.

A proven solution for asset managers, hedge funds, fund administrators, prime brokers, mutual funds, and increasingly, institutional asset managers, Geneva® is the solution of choice for any firm that requires a high level of operational efficiency and easy access to real-time data.

Geneva® has evolved with the alternative segment, and today spans private equity, private credit, real estate and real assets in addition to hedge funds. More than 350 firms worldwide trust Geneva® for their most complex accounting needs, ranging from under $100 million to over $100 billion in assets.